UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 5, 2017

Federal National Mortgage Association

(Exact name of registrant as specified in its charter)

Federally chartered corporation | 000-50231 | 52-0883107 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) | ||

3900 Wisconsin Avenue, NW Washington, DC | 20016 | |||

(Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (800) 2FANNIE (800-232-6643)

(Former name or former address, if changed since last report): ______________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§203.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

The information in this report, including information in the exhibits submitted herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated by reference into any disclosure document relating to Fannie Mae (formally known as the Federal National Mortgage Association), except to the extent, if any, expressly incorporated by specific reference in that document.

Item 2.02 Results of Operations and Financial Condition.

On May 5, 2017, Fannie Mae filed its quarterly report on Form 10-Q for the quarter ended March 31, 2017 and issued a news release reporting its financial results for the periods covered by the Form 10-Q. The news release, a copy of which is furnished as Exhibit 99.1 to this report, is incorporated herein by reference. A copy of the news release may also be found on Fannie Mae’s website, www.fanniemae.com, in the “About Us” section under “Investor Relations/Quarterly and Annual Results.” Information appearing on the company’s website is not incorporated into this report.

Item 7.01 Regulation FD Disclosure.

On May 5, 2017, Fannie Mae posted to its website a 2017 First Quarter Credit Supplement presentation consisting primarily of information about Fannie Mae’s guaranty book of business. The presentation, a copy of which is furnished as Exhibit 99.2 to this report, is incorporated herein by reference. A copy of the presentation may also be found on Fannie Mae’s website, www.fanniemae.com, in the “About Us” section under “Investor Relations/Quarterly and Annual Results.”

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The exhibit index filed herewith is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FEDERAL NATIONAL MORTGAGE ASSOCIATION | ||

By | /s/ David C. Benson | |

David C. Benson | ||

Executive Vice President and Chief Financial Officer | ||

Date: May 5, 2017

EXHIBIT INDEX

The following exhibits are submitted herewith:

Exhibit Number | Description of Exhibit | |

99.1 | ||

99.2 | ||

Resource Center: 1-800-232-6643

Exhibit 99.1

Contact: Pete Bakel

202-752-2034

Date: May 5, 2017

Fannie Mae Reports Net Income of $2.8 Billion and Comprehensive Income of $2.8 Billion for First Quarter 2017

• | Fannie Mae expects to pay $2.8 billion in dividends to Treasury in June 2017. With the expected June 2017 dividend payment, Fannie Mae will have paid a total of $162.7 billion in dividends to Treasury. |

• | Fannie Mae was the largest provider of liquidity to the mortgage market in the first quarter of 2017, providing approximately $136 billion in mortgage financing that enabled families to buy, refinance, or rent homes. |

• | Fannie Mae is focused on providing value to the housing finance system by: |

◦ | delivering increased speed, simplicity, and certainty to customers and serving their needs by building a company that is efficient, innovative, and continuously improving; |

◦ | implementing innovations that deliver greater value and reduced risk to lenders, such as the company’s Day 1 Certainty™ initiative with verification tools to expand representation and warranty relief; and |

◦ | helping make predictable long-term fixed-rate mortgages, including the 30-year fixed-rate mortgage, available to families across the country. |

• | Fannie Mae continues to increase the role of private capital in the mortgage market and reduce the risk to Fannie Mae’s business, taxpayers, and the housing finance system through its credit risk transfer transactions. As of March 31, 2017, approximately 26 percent of the loans in the company’s single-family conventional guaranty book of business, measured by unpaid principal balance, were covered by a credit risk transfer transaction. |

WASHINGTON, DC — Fannie Mae (FNMA/OTC) reported net income of $2.8 billion and comprehensive income of $2.8 billion for the first quarter of 2017. The company reported a positive net worth of $3.4 billion as of March 31, 2017. As a result, the company expects to pay Treasury a $2.8 billion dividend in June 2017.

“Across our business, we are creating new ways to help our customers make the mortgage process easier and safer, and provide options that are affordable to more borrowers,” said Timothy J. Mayopoulos, president and chief executive officer. “Both the market and our operations continued to strengthen, and our progress was reflected in another profitable quarter. We look forward to advancing our vision to create a digital mortgage process, and make new strides in our efforts to encourage the creation of affordable multifamily housing.”

First Quarter 2017 Results — Fannie Mae’s net income of $2.8 billion for the first quarter of 2017 compares to net income of $5.0 billion for the fourth quarter of 2016. The decrease in net income was due primarily to:

• | Significantly smaller increases in interest rates in the first quarter of 2017 as compared with the fourth quarter of 2016. |

◦ | Large increases in longer-term interest rates in the fourth quarter of 2016 resulted in substantial fair value gains on the company’s risk management derivatives for the quarter as well as credit-related expenses that partially offset these gains. |

◦ | By contrast, interest rates increased only slightly in the first quarter of 2017, and therefore did not have a substantial impact on the fair value of the company’s risk management derivatives or its credit-related income for the quarter. |

First Quarter 2017 Results | 1 | |

SUMMARY OF FIRST QUARTER 2017 RESULTS

(Dollars in millions) | 1Q17 | 4Q16 | Variance | 1Q17 | 1Q16 | Variance | ||||||||||||||||||

Net interest income | $ | 5,346 | $ | 5,805 | $ | (459 | ) | $ | 5,346 | $ | 4,769 | $ | 577 | |||||||||||

Fee and other income | 249 | 414 | (165 | ) | 249 | 203 | 46 | |||||||||||||||||

Net revenues | 5,595 | 6,219 | (624 | ) | 5,595 | 4,972 | 623 | |||||||||||||||||

Investment gains (losses), net | (9 | ) | 322 | (331 | ) | (9 | ) | 69 | (78 | ) | ||||||||||||||

Fair value gains (losses), net | (40 | ) | 3,890 | (3,930 | ) | (40 | ) | (2,813 | ) | 2,773 | ||||||||||||||

Administrative expenses | (684 | ) | (714 | ) | 30 | (684 | ) | (688 | ) | 4 | ||||||||||||||

Credit-related income (expense) | ||||||||||||||||||||||||

Benefit (provision) for credit losses | 396 | (1,303 | ) | 1,699 | 396 | 1,184 | (788 | ) | ||||||||||||||||

Foreclosed property expense | (217 | ) | (137 | ) | (80 | ) | (217 | ) | (334 | ) | 117 | |||||||||||||

Total credit-related income (expense) | 179 | (1,440 | ) | 1,619 | 179 | 850 | (671 | ) | ||||||||||||||||

Temporary Payroll Tax Cut Continuation Act of 2011 (TCCA) fees | (503 | ) | (487 | ) | (16 | ) | (503 | ) | (440 | ) | (63 | ) | ||||||||||||

Other expenses, net | (382 | ) | (210 | ) | (172 | ) | (382 | ) | (264 | ) | (118 | ) | ||||||||||||

Income before federal income taxes | 4,156 | 7,580 | (3,424 | ) | 4,156 | 1,686 | 2,470 | |||||||||||||||||

Provision for federal income taxes | (1,383 | ) | (2,545 | ) | 1,162 | (1,383 | ) | (550 | ) | (833 | ) | |||||||||||||

Net income | $ | 2,773 | $ | 5,035 | $ | (2,262 | ) | $ | 2,773 | $ | 1,136 | $ | 1,637 | |||||||||||

Total comprehensive income | $ | 2,779 | $ | 4,871 | $ | (2,092 | ) | $ | 2,779 | $ | 936 | $ | 1,843 | |||||||||||

Dividends distributed or available for distribution to senior preferred stockholder | $ | (2,779 | ) | $ | (5,471 | ) | $ | 2,692 | $ | (2,779 | ) | $ | (919 | ) | $ | (1,860 | ) | |||||||

Net revenues, which consist of net interest income and fee and other income, were $5.6 billion for the first quarter of 2017, compared with $6.2 billion for the fourth quarter of 2016.

The company has two primary sources of net interest income: (1) the guaranty fees it receives for managing the credit risk on loans underlying Fannie Mae mortgage-backed securities held by third parties; and (2) the difference between interest income earned on the assets in its retained mortgage portfolio and the interest expense associated with the debt that funds those assets.

Net interest income was $5.3 billion for the first quarter of 2017, compared with $5.8 billion for the fourth quarter of 2016. The decrease in net interest income for the first quarter of 2017 was due primarily to lower amortization income from mortgage prepayments due to lower refinance activity and lower interest income due to a decline in the average balance of the company’s retained mortgage portfolio as the company continued to reduce this portfolio.

In recent periods, an increasing portion of Fannie Mae’s net interest income has been derived from guaranty fees rather than from the company’s retained mortgage portfolio assets. This shift has been driven by both the guaranty fee increases the company implemented in 2012 and the reduction of the company’s retained mortgage portfolio. More than 75 percent of the company’s net interest income in the first quarter of 2017 was derived from its guaranty business. The company expects that guaranty fees will continue to account for an increasing portion of its net interest income.

First Quarter 2017 Results | 2 | |

Net fair value losses were $40 million in the first quarter of 2017, compared with net fair value gains of $3.9 billion in the fourth quarter of 2016. Net fair value losses for the first quarter of 2017 were due primarily to losses on Connecticut Avenue Securities™ debt reported at fair value resulting from tightening spreads between Connecticut Avenue Securities yields and LIBOR during the quarter. Net fair value losses for the first quarter of 2017 were partially offset by gains on the company’s risk management derivatives due primarily to increases in longer-term swap rates during the first quarter of 2017. Net fair value gains in the fourth quarter of 2016 were due primarily to increases in longer-term interest rates positively impacting the value of the company’s risk management derivatives. Net fair value gains in the fourth quarter of 2016 also were driven by gains on commitments to sell mortgage-related securities driven by a decrease in prices as interest rates increased during the commitment periods in the quarter.

The estimated fair value of the company’s derivatives and securities may fluctuate substantially from period to period because of changes in interest rates, the yield curve, mortgage and credit spreads, implied volatility, and activity related to these financial instruments.

Credit-related income (expense) consists of a benefit or provision for credit losses and foreclosed property expense. Credit-related income was $179 million in the first quarter of 2017, compared with credit-related expense of $1.4 billion in the fourth quarter of 2016. Credit-related income in the first quarter of 2017 was driven primarily by an increase in actual and forecasted home prices.

Credit-related expense in the fourth quarter of 2016 was due primarily to a provision for credit losses driven primarily by an increase in actual and projected interest rates during the quarter. The increase in actual and projected interest rates in the fourth quarter of 2016 increased the impairment on the company’s individually impaired loans primarily related to concessions provided on its modified loans, which was the driver of the provision for credit losses for the quarter.

First Quarter 2017 Results | 3 | |

VARIABILITY OF FINANCIAL RESULTS

Fannie Mae expects to remain profitable on an annual basis for the foreseeable future; however, certain factors, such as changes in interest rates or home prices, could result in significant volatility in the company’s financial results from quarter to quarter or year to year. Fannie Mae’s future financial results also will be affected by a number of other factors, including: the company’s guaranty fee rates; the volume of single-family mortgage originations in the future; the size, composition, and quality of its retained mortgage portfolio and guaranty book of business; and economic and housing market conditions. Although Fannie Mae expects to remain profitable on an annual basis for the foreseeable future, due to the company’s limited and declining capital reserves (which decrease to zero in 2018) and the potential for significant volatility in its financial results, the company could experience a net worth deficit in a future quarter. If Fannie Mae experiences a net worth deficit in a future quarter, the company will be required to draw additional funds from Treasury under the senior preferred stock purchase agreement to avoid being placed into receivership.

The company’s expectations for its future financial results do not take into account the impact on its business of potential future legislative or regulatory changes, which could have a material impact on the company’s financial results, particularly the enactment of housing finance reform legislation, corporate income tax reform legislation, and changes in accounting standards. For example, the current Administration proposes reducing the U.S. corporate income tax rate. Under applicable accounting standards, a significant reduction in the U.S. corporate income tax rate would require the company to record a substantial reduction in the value of its deferred tax assets in the quarter in which the legislation is enacted. Thus, if legislation significantly lowering the U.S. corporate income tax rate is enacted, the company expects to incur a significant net loss and net worth deficit for the quarter in which the legislation is enacted and could potentially incur a net loss for that year. If the company experiences a net worth deficit in a future quarter, it will be required to draw additional funds from Treasury under the senior preferred stock purchase agreement in order to avoid being placed into receivership. For additional information on factors that affect the company’s financial results, please refer to the company’s quarterly report on Form 10-Q for the quarter ended March 31, 2017 (the “First Quarter 2017 Form 10-Q”).

SUMMARY OF FIRST QUARTER 2017 BUSINESS SEGMENT RESULTS

Fannie Mae’s two reportable business segments—Single-Family and Multifamily—engage in complementary business activities in pursuing Fannie Mae’s vision to be America’s most valued housing partner and to provide liquidity, access to credit, and affordability in all U.S. housing markets at all times, while effectively managing and reducing risk to Fannie Mae’s business, taxpayers, and the housing finance system. In support of this vision, Fannie Mae is focused on: advancing a sustainable and reliable business model that reduces risk to the housing finance system and taxpayers; providing reliable, large-scale access to affordable mortgage credit for qualified borrowers and helping struggling homeowners; and serving customer needs by building a company that is efficient, innovative, and continuously improving.

First Quarter 2017 Results | 4 | |

(Dollars in millions) | 1Q17 | 4Q16 | Variance | 1Q17 | 1Q16 | Variance | ||||||||||||||||||

Single-Family Segment: | ||||||||||||||||||||||||

Net interest income | $ | 4,756 | $ | 5,178 | $ | (422 | ) | $ | 4,756 | $ | 4,245 | $ | 511 | |||||||||||

Fee and other income | 76 | 299 | (223 | ) | 76 | 67 | 9 | |||||||||||||||||

Net revenues | 4,832 | 5,477 | (645 | ) | 4,832 | 4,312 | 520 | |||||||||||||||||

Credit-related income (expense) | 184 | (1,456 | ) | 1,640 | 184 | 828 | (644 | ) | ||||||||||||||||

Investment gains (losses), net | (50 | ) | 209 | (259 | ) | (50 | ) | 56 | (106 | ) | ||||||||||||||

Fair value gains (losses), net | (12 | ) | 3,988 | (4,000 | ) | (12 | ) | (2,850 | ) | 2,838 | ||||||||||||||

Administrative expenses | (601 | ) | (630 | ) | 29 | (601 | ) | (609 | ) | 8 | ||||||||||||||

TCCA fees | (503 | ) | (487 | ) | (16 | ) | (503 | ) | (440 | ) | (63 | ) | ||||||||||||

Other expenses | (256 | ) | (239 | ) | (17 | ) | (256 | ) | (246 | ) | (10 | ) | ||||||||||||

Income before federal income taxes | 3,594 | 6,862 | (3,268 | ) | 3,594 | 1,051 | 2,543 | |||||||||||||||||

Provision for federal income taxes | (1,252 | ) | (2,375 | ) | 1,123 | (1,252 | ) | (389 | ) | (863 | ) | |||||||||||||

Net income | $ | 2,342 | $ | 4,487 | $ | (2,145 | ) | $ | 2,342 | $ | 662 | $ | 1,680 | |||||||||||

Multifamily Segment: | ||||||||||||||||||||||||

Net interest income | $ | 590 | $ | 627 | $ | (37 | ) | $ | 590 | $ | 524 | $ | 66 | |||||||||||

Fee and other income | 173 | 115 | 58 | 173 | 136 | 37 | ||||||||||||||||||

Net revenues | 763 | 742 | 21 | 763 | 660 | 103 | ||||||||||||||||||

Credit-related income (expense) | (5 | ) | 16 | (21 | ) | (5 | ) | 22 | (27 | ) | ||||||||||||||

Fair value gains (losses), net | (28 | ) | (98 | ) | 70 | (28 | ) | 37 | (65 | ) | ||||||||||||||

Administrative expenses | (83 | ) | (84 | ) | 1 | (83 | ) | (79 | ) | (4 | ) | |||||||||||||

Other income (expense) | (85 | ) | 142 | (227 | ) | (85 | ) | (5 | ) | (80 | ) | |||||||||||||

Income before federal income taxes | 562 | 718 | (156 | ) | 562 | 635 | (73 | ) | ||||||||||||||||

Provision for federal income taxes | (131 | ) | (170 | ) | 39 | (131 | ) | (161 | ) | 30 | ||||||||||||||

Net income | $ | 431 | $ | 548 | $ | (117 | ) | $ | 431 | $ | 474 | $ | (43 | ) | ||||||||||

Single-Family Business

• | Single-Family net income was $2.3 billion in the first quarter of 2017, compared with $4.5 billion in the fourth quarter of 2016. Net income for the first quarter of 2017 was driven primarily by net interest income and credit-related income. |

• | Single-Family net interest income was $4.8 billion in the first quarter of 2017, compared with $5.2 billion in the fourth quarter of 2016. The decrease in net interest income for the first quarter of 2017 was due primarily to lower amortization income from mortgage prepayments due to lower refinance activity and lower interest income due to a decline in the average balance of the company’s single-family retained mortgage portfolio as the company continued to reduce this portfolio. |

• | Single-Family credit-related income was $184 million in the first quarter of 2017, compared with credit-related expense of $1.5 billion in the fourth quarter of 2016. Credit-related income in the first quarter of 2017 was driven primarily by an increase actual and forecasted home prices. |

• | Single-Family net fair value losses were $12 million in the first quarter of 2017, compared with net fair value gains of $4.0 billion in the fourth quarter of 2016. Net fair value losses for the first quarter of 2017 were due primarily to losses on Connecticut Avenue Securities debt reported at fair value resulting from tightening spreads between Connecticut Avenue Securities yields and LIBOR during the quarter. These fair value losses were partially offset by gains on the company’s risk management derivatives due primarily to increases in longer-term swap rates during the first quarter of 2017. |

First Quarter 2017 Results | 5 | |

Multifamily Business

• | Multifamily net income was $431 million in the first quarter of 2017, compared with $548 million in the fourth quarter of 2016. Net income in the first quarter of 2017 was driven primarily by net interest income. |

• | Multifamily net interest income was $590 million in the first quarter of 2017, compared with $627 million in the fourth quarter of 2016. The decrease in net interest income was due primarily to a decline in the average balance of the multifamily retained mortgage portfolio, as well as lower amortization income due to lower prepayments in the first quarter of 2017. The decrease in net interest income was partially offset by higher guaranty fee income as the company’s multifamily guaranty book of business grew and loans with higher guaranty fees became a larger part of its book, while loans with lower guaranty fees continued to liquidate. |

• | Multifamily net fair value losses were $28 million in the first quarter of 2017, compared with $98 million in the fourth quarter of 2016. Net fair value losses in the first quarter of 2017 were driven primarily by losses on our multifamily commitments to sell mortgage-related securities as a result of increases in prices during the commitment periods. |

• | Multifamily new business volume totaled $17.4 billion for the first quarter of 2017, of which approximately 62 percent counted toward FHFA’ s 2017 multifamily volume cap. |

BUILDING A SUSTAINABLE HOUSING FINANCE SYSTEM

In addition to continuing to provide liquidity and support to the mortgage market, Fannie Mae has invested significant resources toward helping to maintain a safer and sustainable housing finance system for today and build a safer and sustainable housing finance system for the future. The company is pursuing the strategic goals identified by its conservator, the Federal Housing Finance Agency (FHFA). These strategic goals are: maintain, in a safe and sound manner, credit availability and foreclosure prevention activities for new and refinanced mortgages to foster liquid, efficient, competitive, and resilient national housing finance markets; reduce taxpayer risk through increasing the role of private capital in the mortgage market; and build a new single-family infrastructure for use by Fannie Mae and Freddie Mac and adaptable for use by other participants in the secondary market in the future.

ABOUT FANNIE MAE’S CONSERVATORSHIP AND AGREEMENTS WITH TREASURY

Fannie Mae has operated under the conservatorship of FHFA since September 6, 2008. Treasury has made a commitment under a senior preferred stock purchase agreement to provide funding to Fannie Mae under certain circumstances if the company has a net worth deficit. Pursuant to this agreement and the senior preferred stock the company issued to Treasury in 2008, the Director of FHFA has directed Fannie Mae to pay dividends to Treasury on a quarterly basis since entering into conservatorship in 2008.

The chart below shows the funds the company has drawn from Treasury pursuant to the senior preferred stock purchase agreement, as well as the dividend payments the company has made to Treasury on the senior preferred stock, since entering into conservatorship.

First Quarter 2017 Results | 6 | |

__________

(1) | Under the terms of the senior preferred stock purchase agreement, dividend payments the company makes to Treasury do not offset the company’s prior draws of funds from Treasury, and the company is not permitted to pay down draws it has made under the agreement except in limited circumstances. Accordingly, the current aggregate liquidation preference of the senior preferred stock is $117.1 billion, due to the initial $1.0 billion liquidation preference of the senior preferred stock (for which the company did not receive cash proceeds) and the $116.1 billion the company has drawn from Treasury. Amounts may not sum due to rounding. |

(2) | Treasury draws are shown in the period for which requested, not when the funds were received by the company. Fannie Mae has not requested a draw for any period since 2012. |

Fannie Mae expects to pay Treasury a dividend of $2.8 billion for the second quarter of 2017 by June 30, 2017, calculated based on the company’s net worth of $3.4 billion as of March 31, 2017, less the current capital reserve amount of $600 million.

In August 2012, the terms governing the company’s dividend obligations on the senior preferred stock were amended. The amended senior preferred stock purchase agreement does not allow the company to build a capital reserve. Beginning in 2013, the required senior preferred stock dividends each quarter equal the amount, if any, by which the company’s net worth as of the end of the immediately preceding fiscal quarter exceeds an applicable capital reserve amount. The capital reserve amount is $600 million for each quarter of 2017 and will decrease to zero in 2018.

The amount of remaining funding available to Fannie Mae under the senior preferred stock purchase agreement with Treasury is currently $117.6 billion. If the company were to draw additional funds from Treasury under the agreement in a future period, the amount of remaining funding under the agreement would be reduced by the amount of the company’s draw. Dividend payments Fannie Mae makes to Treasury do not restore or increase the amount of funding available to the company under the agreement.

Fannie Mae is not permitted to redeem the senior preferred stock prior to the termination of Treasury’s funding commitment under the senior preferred stock purchase agreement. The limited circumstances under which Treasury’s funding commitment will terminate are described in “Business—Conservatorship and Treasury Agreements” in the company’s annual report on Form 10-K for the year ended December 31, 2016 (the “2016 Form 10-K”).

First Quarter 2017 Results | 7 | |

CREDIT RISK TRANSFER TRANSACTIONS

In late 2013, Fannie Mae began entering into credit risk transfer transactions with the goal of transferring, to the extent economically sensible, a portion of the mortgage credit risk on some of the recently-acquired loans in its single-family book of business in order to reduce the economic risk to the company and taxpayers of future borrower defaults. Fannie Mae’s primary method of achieving this goal has been through the issuance of its Connecticut Avenue Securities (CAS) and its Credit Insurance Risk Transfer™ (CIRT™) transactions. In these transactions, the company transfers to investors a portion of the mortgage credit risk associated with losses on a reference pool of mortgage loans and in exchange pays investors a premium that effectively reduces the guaranty fee income the company retains on the loans.

As of March 31, 2017, $723 billion in outstanding unpaid principal balance of the company’s single-family loans, or approximately 26 percent of the loans in its single-family conventional guaranty book of business measured by unpaid principal balance, were included in a reference pool for a credit risk transfer transaction. During the first quarter of 2017, the company transferred a portion of the mortgage credit risk on single-family mortgages with unpaid principal balance of $108 billion at the time of the transactions.

These transactions increase the role of private capital in the mortgage market and reduce the risk to Fannie Mae’s business, taxpayers, and the housing finance system. Over time, the company expects that a larger portion of its single-family conventional guaranty book of business will be covered by credit risk transfer transactions.

The chart below shows as of the dates specified the total outstanding unpaid principal balance of Fannie Mae’s single-family loans, as well as the percentage of the company’s total single-family conventional guaranty book of business measured by unpaid principal balance, that were included in a reference pool for a credit risk transfer transaction.

CREDIT QUALITY

While continuing to make it possible for families to buy, refinance, or rent homes, Fannie Mae has maintained responsible credit standards. Since 2009, Fannie Mae has seen the effect of the actions it took, beginning in 2008, to significantly strengthen its underwriting and eligibility standards to promote sustainable homeownership and stability in the housing market. Fannie Mae actively monitors the credit risk profile and credit performance of the company’s single-family loan acquisitions, in conjunction with housing market and economic conditions, to determine if its pricing, eligibility, and underwriting criteria accurately reflect the risks associated with loans the company acquires or guarantees. Single-family conventional loans acquired by Fannie Mae in the first quarter of 2017 had a weighted average borrower FICO credit score at origination of 746 and a weighted average original loan-to-value ratio of 73 percent.

As of March 31, 2017, 88 percent of the company’s single-family conventional guaranty book of business consisted of loans acquired since 2009.

First Quarter 2017 Results | 8 | |

* Fannie Mae has acquired HARP loans and other Refi Plus loans under its Refi PlusTM initiative since 2009. Fannie Mae’s Refi Plus initiative offers refinancing flexibility to eligible borrowers who are current on their loans and whose loans are owned or guaranteed by the company and meet certain additional criteria. HARP loans, which have loan-to-value (“LTV”) ratios at origination greater than 80 percent, refers to loans the company has acquired pursuant to the Home Affordable Refinance Program® (“HARP®”). Other Refi Plus loans, which have LTV ratios at origination of 80 percent or less, refers to loans the company has acquired under its Refi Plus initiative other than HARP loans. Loans the company acquires under Refi Plus and HARP are refinancings of loans that were originated prior to June 2009.

The single-family serious delinquency rate for Fannie Mae’s book of business has decreased for 28 consecutive quarters since the first quarter of 2010 and was 1.12 percent as of March 31, 2017, compared with 5.47 percent as of March 31, 2010.

Fannie Mae expects its single-family serious delinquency rate to continue to decline; however, as the single-family serious delinquency rate has already declined significantly over the past several years, the company expects more modest declines in this rate in the future. The company’s single-family serious delinquency rate and the period of time that loans remain seriously delinquent continue to be negatively affected by the length of time required to complete a foreclosure in some states. Other factors that affect the company’s single-family serious delinquency rate include the pace of loan modifications, the timing and volume of nonperforming loan sales we make, servicer performance, and changes in home prices, unemployment levels and other macroeconomic conditions.

First Quarter 2017 Results | 9 | |

Combined loss reserves, which reflect the company’s estimate of the probable losses the company has incurred in its guaranty book of business, including concessions it granted borrowers upon modification of their loans, decreased to $22.5 billion as of March 31, 2017 from $23.8 billion as of December 31, 2016. The decrease in the company’s combined loss reserves for the first quarter of 2017 was driven primarily by redesignations of loans from held for investment to held for sale and charge-offs, which relieved the allowance on these loans, as well as an increase in actual and forecasted home prices. The company’s loss reserves have declined in recent years and are expected to decline further in 2017; however, the company expects a smaller decline in its loss reserves in 2017 than the decline in 2016.

PROVIDING LIQUIDITY AND SUPPORT TO THE MARKET

Liquidity

Fannie Mae provided approximately $136 billion in liquidity to the mortgage market in the first quarter of 2017, through its purchases of loans and guarantees of loans and securities, which resulted in:

• | Approximately 233,000 home purchases |

• | Approximately 303,000 mortgage refinancings |

• | Approximately 202,000 units of multifamily housing financed |

First Quarter 2017 Results | 10 | |

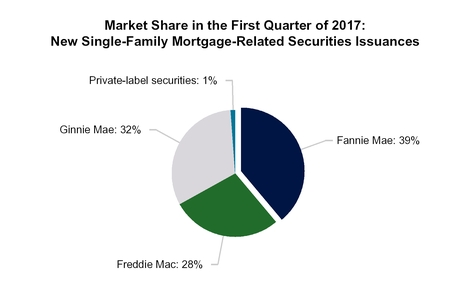

The company was the largest issuer of single-family mortgage-related securities in the secondary market in the first quarter of 2017, with an estimated market share of new single-family mortgage-related securities issuances of 39 percent, compared with 41 percent in the fourth quarter of 2016 and 37 percent in the first quarter of 2016.

The chart below shows the company’s market share of single-family mortgage-related securities issuances in the first quarter of 2017 compared with that of its primary competitors.

Fannie Mae also remained a continuous source of liquidity in the multifamily market in the first quarter of 2017. As of December 31, 2016 (the latest date for which information is available), the company owned or guaranteed approximately 19 percent of the outstanding debt on multifamily properties.

Refinancing Initiatives

Through the company’s Refi Plus initiative, which offers refinancing flexibility to eligible Fannie Mae borrowers and includes HARP, the company acquired approximately 33,000 loans in the first quarter of 2017. Refinancings

First Quarter 2017 Results | 11 | |

delivered to Fannie Mae through Refi Plus in the first quarter of 2017 reduced borrowers’ monthly mortgage payments by an average of $213.

Home Retention Solutions and Foreclosure Alternatives

To reduce the credit losses Fannie Mae ultimately incurs on its book of business, the company has been focusing its efforts on several strategies, including reducing defaults by offering home retention solutions, such as loan modifications.

For the Three Months Ended March 31, | |||||||||||||

2017 | 2016 | ||||||||||||

Unpaid Principal Balance | Number of Loans | Unpaid Principal Balance | Number of Loans | ||||||||||

(Dollars in millions) | |||||||||||||

Home retention solutions: | |||||||||||||

Modifications | $ | 3,343 | 19,928 | $ | 3,451 | 20,899 | |||||||

Repayment plans and forbearances completed | 262 | 1,895 | 175 | 1,296 | |||||||||

Total home retention solutions | 3,605 | 21,823 | 3,626 | 22,195 | |||||||||

Foreclosure alternatives: | |||||||||||||

Short sales | 450 | 2,181 | 611 | 2,995 | |||||||||

Deeds-in-lieu of foreclosure | 178 | 1,153 | 265 | 1,745 | |||||||||

Total foreclosure alternatives | 628 | 3,334 | 876 | 4,740 | |||||||||

Total loan workouts | $ | 4,233 | 25,157 | $ | 4,502 | 26,935 | |||||||

Loan workouts as a percentage of single-family guaranty book of business | 0.59 | % | 0.58 | % | 0.64 | % | 0.62 | % | |||||

Fannie Mae views foreclosure as a last resort. For homeowners and communities in need, the company offers alternatives to foreclosure. In dealing with homeowners in distress, the company first seeks home retention solutions, which enable borrowers to stay in their homes, before turning to foreclosure alternatives.

• | Fannie Mae provided approximately 25,000 loan workouts during the first quarter of 2017 enabling borrowers to avoid foreclosure. |

• | Fannie Mae completed approximately 20,000 loan modifications during the first quarter of 2017. |

First Quarter 2017 Results | 12 | |

FORECLOSURES AND REAL ESTATE OWNED (REO) PROPERTIES

When there is no viable home retention solution or foreclosure alternative that can be applied, the company seeks to move to foreclosure expeditiously in an effort to minimize prolonged delinquencies that can hurt local home values and destabilize communities.

For the Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Single-family foreclosed properties (number of properties): | |||||||

Beginning of period inventory of single-family foreclosed properties (REO) | 38,093 | 57,253 | |||||

Total properties acquired through foreclosure | 11,186 | 16,367 | |||||

Dispositions of REO | (14,728 | ) | (21,331 | ) | |||

End of period inventory of single-family foreclosed properties (REO) | 34,551 | 52,289 | |||||

Carrying value of single-family foreclosed properties (dollars in millions) | $ | 3,951 | $ | 5,963 | |||

Single-family foreclosure rate | 0.26 | % | 0.38 | % | |||

• | Fannie Mae acquired 11,186 single-family REO properties, primarily through foreclosure, in the first quarter of 2017, compared with 10,736 in the fourth quarter of 2016. |

• | As of March 31, 2017, the company’s inventory of single-family REO properties was 34,551, compared with 38,093 as of December 31, 2016. The carrying value of the company’s single-family REO was $4.0 billion as of March 31, 2017. |

• | The company’s single-family foreclosure rate was 0.26 percent for the three months ended March 31, 2017. This reflects the annualized total number of single-family properties acquired through foreclosure or deeds-in-lieu of foreclosure as a percentage of the total number of loans in Fannie Mae’s single-family guaranty book of business. |

Fannie Mae’s financial statements for the first quarter of 2017 are available in the accompanying Annex; however, investors and interested parties should read the company’s First Quarter 2017 Form 10-Q, which was filed today with the Securities and Exchange Commission and is available on Fannie Mae’s website, www.fanniemae.com. The company provides further discussion of its financial results and condition, credit performance, and other matters in its First Quarter 2017 Form 10-Q. Additional information about the company’s credit performance, the characteristics of its guaranty book of business, its foreclosure-prevention efforts, and other measures is contained in the “2017 First Quarter Credit Supplement” at www.fanniemae.com.

# # #

In this release, the company has presented a number of estimates, forecasts, expectations, and other forward-looking statements, including statements regarding: its future dividend payments to Treasury; the impact of and future plans with respect to the company’s credit risk transfer transactions; the sources of its future net interest income; the company’s future profitability; the factors that will affect the company’s future financial results; the company’s future serious delinquency rates and the factors that will affect the company’s future single-family serious delinquency rates; the future fair value of the company’s financial instruments; the company’s future loss reserves; and the impact of the company’s actions to reduce credit losses. These estimates, forecasts, expectations, and statements are forward-looking statements based on the company’s current assumptions regarding numerous factors. Actual results, and future projections, could be materially different from what is set forth in the forward-looking statements as a result of: home price changes; interest rate changes; unemployment rates; other macroeconomic and housing market variables; the company’s future serious delinquency rates; the company’s future guaranty fee pricing and the impact of that pricing on the company’s guaranty fee revenues and competitive environment; government policy; credit availability; changes in borrower behavior; the volume of loans it modifies; the effectiveness of its loss mitigation strategies; significant changes in modification and foreclosure activity; the volume and pace of future nonperforming loan sales and their impact on the company’s results and serious delinquency rates; the effectiveness of its management of its real estate owned inventory and pursuit of contractual remedies; changes in the fair value of its assets and liabilities; future legislative or regulatory requirements or changes that have a significant impact on the company’s business, such as the enactment of housing finance reform legislation or corporate income tax reform legislation; actions by FHFA, Treasury, the Department of Housing and

First Quarter 2017 Results | 13 | |

Urban Development or other regulators that affect the company’s business; the size, composition and quality of the company’s guaranty book of business and retained mortgage portfolio; the company’s market share; the life of the loans in the company’s guaranty book of business; future updates to the company’s models relating to loss reserves, including the assumptions used by these models; changes in generally accepted accounting principles; changes to the company’s accounting policies; whether the company’s counterparties meet their obligations in full; effects from activities the company takes to support the mortgage market and help borrowers; the company’s future objectives and activities in support of those objectives, including actions the company may take to reach additional underserved creditworthy borrowers; actions the company may be required to take by FHFA, in its role as the company’s conservator or as its regulator, such as changes in the type of business the company does or the implementation of the Single Security Initiative for Fannie Mae and Freddie Mac; limitations on the company’s business imposed by FHFA, in its role as the company’s conservator or as its regulator; the conservatorship and its effect on the company’s business; the investment by Treasury and its effect on the company’s business; the uncertainty of the company’s future; challenges the company faces in retaining and hiring qualified executives and other employees; the deteriorated credit performance of many loans in the company’s guaranty book of business; a decrease in the company’s credit ratings; defaults by one or more institutional counterparties; resolution or settlement agreements the company may enter into with its counterparties; operational control weaknesses; changes in the fiscal and monetary policies of the Federal Reserve, including any change in the Federal Reserve’s policy toward the reinvestment of principal payments of mortgage-backed securities or any future sales of such securities; changes in the structure and regulation of the financial services industry; the company’s ability to access the debt markets; disruptions in the housing, credit, and stock markets; government investigations and litigation; the company’s reliance on and the performance of the company’s servicers; conditions in the foreclosure environment; global political risks; natural disasters, environmental disasters, terrorist attacks, pandemics, or other major disruptive events; information security breaches or threats; and many other factors, including those discussed in the “Risk Factors” and “Forward-Looking Statements” sections of and elsewhere in the company’s annual report on Form 10-K for the year ended December 31, 2016 and the company’s quarterly report on Form 10-Q for the quarter ended March 31, 2017, and elsewhere in this release.

Fannie Mae provides website addresses in its news releases solely for readers’ information. Other content or information appearing on these websites is not part of this release.

Fannie Mae helps make the 30-year fixed-rate mortgage and affordable rental housing possible for millions of Americans. We partner with lenders to create housing opportunities for families across the country. We are driving positive changes in housing finance to make the home buying process easier, while reducing costs and risk. To learn more, visit fanniemae.com and follow us on twitter.com/fanniemae.

First Quarter 2017 Results | 14 | |

ANNEX

FANNIE MAE

(In conservatorship)

Condensed Consolidated Balance Sheets — (Unaudited)

(Dollars in millions, except share amounts)

As of | |||||||||||

March 31, | December 31, | ||||||||||

2017 | 2016 | ||||||||||

ASSETS | |||||||||||

Cash and cash equivalents | $ | 24,988 | $ | 25,224 | |||||||

Restricted cash (includes $22,642 and $31,536, related to consolidated trusts) | 27,321 | 36,953 | |||||||||

Federal funds sold and securities purchased under agreements to resell or similar arrangements | 35,260 | 30,415 | |||||||||

Investments in securities: | |||||||||||

Trading, at fair value (includes $1,066 and $1,277, respectively, pledged as collateral ) | 37,684 | 40,562 | |||||||||

Available-for-sale, at fair value (includes $113 and $107, respectively, related to consolidated trusts) | 7,721 | 8,363 | |||||||||

Total investments in securities | 45,405 | 48,925 | |||||||||

Mortgage loans: | |||||||||||

Loans held for sale, at lower of cost or fair value | 5,024 | 2,899 | |||||||||

Loans held for investment, at amortized cost: | |||||||||||

Of Fannie Mae | 187,211 | 204,318 | |||||||||

Of consolidated trusts | 2,939,396 | 2,896,001 | |||||||||

Total loans held for investment (includes $11,683 and $12,057, respectively, at fair value) | 3,126,607 | 3,100,319 | |||||||||

Allowance for loan losses | (22,129 | ) | (23,465 | ) | |||||||

Total loans held for investment, net of allowance | 3,104,478 | 3,076,854 | |||||||||

Total mortgage loans | 3,109,502 | 3,079,753 | |||||||||

Deferred tax assets, net | 32,647 | 33,530 | |||||||||

Accrued interest receivable (includes $7,089 and $7,064, respectively, related to consolidated trusts) | 7,704 | 7,737 | |||||||||

Acquired property, net | 4,103 | 4,489 | |||||||||

Other assets | 16,824 | 20,942 | |||||||||

Total assets | $ | 3,303,754 | $ | 3,287,968 | |||||||

LIABILITIES AND EQUITY | |||||||||||

Liabilities: | |||||||||||

Accrued interest payable (includes $8,311 and $8,285, respectively, related to consolidated trusts) | $ | 9,588 | $ | 9,431 | |||||||

Debt: | |||||||||||

Of Fannie Mae (includes $9,162 and $9,582, respectively, at fair value) | 327,183 | 327,097 | |||||||||

Of consolidated trusts (includes $36,372 and $36,524, respectively, at fair value) | 2,954,471 | 2,935,219 | |||||||||

Other liabilities (includes $336 and $390, respectively, related to consolidated trusts) | 9,133 | 10,150 | |||||||||

Total liabilities | 3,300,375 | 3,281,897 | |||||||||

Commitments and contingencies | — | — | |||||||||

Stockholders’ equity: | |||||||||||

Senior preferred stock, 1,000,000 shares issued and outstanding | 117,149 | 117,149 | |||||||||

Preferred stock, 700,000,000 shares are authorized—555,374,922 shares issued and outstanding | 19,130 | 19,130 | |||||||||

Common stock, no par value, no maximum authorization—1,308,762,703 shares issued, 1,158,087,567 and 1,158,082,750 shares outstanding, respectively | 687 | 687 | |||||||||

Accumulated deficit | (126,952 | ) | (124,253 | ) | |||||||

Accumulated other comprehensive income | 765 | 759 | |||||||||

Treasury stock, at cost, 150,675,136 and 150,679,953 shares, respectively | (7,400 | ) | (7,401 | ) | |||||||

Total equity | 3,379 | 6,071 | |||||||||

Total liabilities and equity | $ | 3,303,754 | $ | 3,287,968 | |||||||

See Notes to Condensed Consolidated Financial Statements in the First Quarter 2017 Form 10-Q

First Quarter 2017 Results | 15 | |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Operations and Comprehensive Income — (Unaudited)

(Dollars and shares in millions, except per share amounts)

For the Three Months Ended March 31, | |||||||||

2017 | 2016 | ||||||||

Interest income: | |||||||||

Trading securities | $ | 142 | $ | 120 | |||||

Available-for-sale securities | 101 | 203 | |||||||

Mortgage loans (includes $24,954 and $24,626, respectively, related to consolidated trusts) | 27,047 | 26,961 | |||||||

Other | 94 | 48 | |||||||

Total interest income | 27,384 | 27,332 | |||||||

Interest expense: | |||||||||

Short-term debt | 44 | 51 | |||||||

Long-term debt (includes $20,308 and $20,658, respectively, related to consolidated trusts) | 21,994 | 22,512 | |||||||

Total interest expense | 22,038 | 22,563 | |||||||

Net interest income | 5,346 | 4,769 | |||||||

Benefit for credit losses | 396 | 1,184 | |||||||

Net interest income after benefit for credit losses | 5,742 | 5,953 | |||||||

Investment gains (losses), net | (9 | ) | 69 | ||||||

Fair value losses, net | (40 | ) | (2,813 | ) | |||||

Fee and other income | 249 | 203 | |||||||

Non-interest income (loss) | 200 | (2,541 | ) | ||||||

Administrative expenses: | |||||||||

Salaries and employee benefits | 344 | 364 | |||||||

Professional services | 229 | 215 | |||||||

Occupancy expenses | 46 | 45 | |||||||

Other administrative expenses | 65 | 64 | |||||||

Total administrative expenses | 684 | 688 | |||||||

Foreclosed property expense | 217 | 334 | |||||||

Temporary Payroll Tax Cut Continuation Act of 2011 (“TCCA”) fees | 503 | 440 | |||||||

Other expenses, net | 382 | 264 | |||||||

Total expenses | 1,786 | 1,726 | |||||||

Income before federal income taxes | 4,156 | 1,686 | |||||||

Provision for federal income taxes | (1,383 | ) | (550 | ) | |||||

Net income | 2,773 | 1,136 | |||||||

Other comprehensive income (loss): | |||||||||

Changes in unrealized gains on available-for-sale securities, net of reclassification adjustments and taxes | 8 | (198 | ) | ||||||

Other | (2 | ) | (2 | ) | |||||

Total other comprehensive income (loss) | 6 | (200 | ) | ||||||

Total comprehensive income | $ | 2,779 | $ | 936 | |||||

Net income | $ | 2,773 | $ | 1,136 | |||||

Dividends distributed or available for distribution to senior preferred stockholder | (2,779 | ) | (919 | ) | |||||

Net income (loss) attributable to common stockholders | $ | (6 | ) | $ | 217 | ||||

Earnings (loss) per share: | |||||||||

Basic | $ | 0.00 | $ | 0.04 | |||||

Diluted | 0.00 | 0.04 | |||||||

Weighted-average common shares outstanding: | |||||||||

Basic | 5,762 | 5,762 | |||||||

Diluted | 5,762 | 5,893 | |||||||

See Notes to Condensed Consolidated Financial Statements in the First Quarter 2017 Form 10-Q

First Quarter 2017 Results | 16 | |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Cash Flows— (Unaudited)

(Dollars in millions)

For the Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Net cash provided by (used in) operating activities | $ | 2,673 | $ | (3,111 | ) | ||

Cash flows provided by investing activities: | |||||||

Proceeds from maturities and paydowns of trading securities held for investment | 579 | 975 | |||||

Proceeds from sales of trading securities held for investment | 66 | 792 | |||||

Proceeds from maturities and paydowns of available-for-sale securities | 594 | 883 | |||||

Proceeds from sales of available-for-sale securities | 151 | 3,802 | |||||

Purchases of loans held for investment | (41,206 | ) | (39,935 | ) | |||

Proceeds from repayments of loans acquired as held for investment of Fannie Mae | 6,718 | 5,026 | |||||

Proceeds from sales of loans acquired as held for investment of Fannie Mae | — | 849 | |||||

Proceeds from repayments and sales of loans acquired as held for investment of consolidated trusts | 97,415 | 104,669 | |||||

Net change in restricted cash | 9,632 | (2,994 | ) | ||||

Advances to lenders | (28,703 | ) | (25,635 | ) | |||

Proceeds from disposition of acquired property and preforeclosure sales | 3,454 | 4,129 | |||||

Net change in federal funds sold and securities purchased under agreements to resell or similar arrangements | (4,845 | ) | 9,800 | ||||

Other, net | (330 | ) | (545 | ) | |||

Net cash provided by investing activities | 43,525 | 61,816 | |||||

Cash flows used in financing activities: | |||||||

Proceeds from issuance of debt of Fannie Mae | 230,272 | 180,322 | |||||

Payments to redeem debt of Fannie Mae | (230,655 | ) | (196,016 | ) | |||

Proceeds from issuance of debt of consolidated trusts | 78,443 | 71,723 | |||||

Payments to redeem debt of consolidated trusts | (119,208 | ) | (107,575 | ) | |||

Payments of cash dividends on senior preferred stock to Treasury | (5,471 | ) | (2,859 | ) | |||

Other, net | 185 | (58 | ) | ||||

Net cash used in financing activities | (46,434 | ) | (54,463 | ) | |||

Net increase (decrease) in cash and cash equivalents | (236 | ) | 4,242 | ||||

Cash and cash equivalents at beginning of period | 25,224 | 14,674 | |||||

Cash and cash equivalents at end of period | $ | 24,988 | $ | 18,916 | |||

Cash paid during the period for: | |||||||

Interest | $ | 25,954 | $ | 26,013 | |||

Income taxes | — | 360 | |||||

See Notes to Condensed Consolidated Financial Statements in the First Quarter 2017 Form 10-Q

First Quarter 2017 Results | 17 | |

2017 First Quarter Credit Supplement

May 5, 2017

© 2017 Fannie Mae. Trademarks of Fannie Mae.

Exhibit 99.2

This presentation includes information about Fannie Mae, including information contained in

Fannie Mae’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, the “2017

Q1 Form 10-Q.” Some of the terms used in these materials are defined and discussed more

fuly in the 2017 Q1 Form 10-Q and in Fannie Mae’s Form 10-K for the year ended December

31, 2016, the “2016 Form 10-K.” These materials should be reviewed together with the 2017

Q1 Form 10-Q and the 2016 Form 10-K, copies of which are available through the

“SEC Filings” page in the “About Us/Investor Relations” section of Fannie Mae’s website at

www.fanniemae.com.

Some of the information in this presentation is based upon information that we received from

third-party sources such as selers and servicers of mortgage loans. Although we generaly

consider this information reliable, we do not independently verify al reported information.

Due to rounding, amounts reported in this presentation may not add to totals indicated (or

100%).

Unless otherwise indicated data labeled as “YTD 2017” is as of March 31, 2017 or for the first

three months of 2017.

§

.

.§

.

§

§

© 2017 Fannie Mae. Trademarks of Fannie Mae.

© 2017 Fannie Mae. Trademarks of Fannie Mae. 2

Table of Contents

Home Price Growth/Decline Rates in the U.S.

One Year Home Price Change as of 2017 Q1

Home Price Change From 2006 Q3 Through 2017 Q1 5

4

3

Home Prices

Credit Characteristics of Single-Family Business Acquisitions

Credit Risk Profile Summary of Single-Family Business Acquisitions

Certain Credit Characteristics of Single-Family Business Acquisitions: 2006 - 2017

Single-Family Business Acquisitions by Loan Purpose

Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Origination Year

Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Certain Product Features 11

10

9

8

7

6

Credit Profile of Fannie Mae Single-Family Loans

Credit Characteristics of Single-Family Conventional Guaranty Book of Business and Single-Family Real Estate Owned (REO) in Select States

Seriously Delinquent Loan and REO Ending Inventory Share by Select States

Single-Family Short Sales and REO Sales Prices to Unpaid Principal Balance (UPB) of Mortgage Loans 14

13

12

Geographic Credit Profile of Fannie Mae Single-Family Loans and Foreclosed Properties (REO)

Single-Family Loan Workouts

Re-performance Rates of Modified Single-Family Loans 16

15

Workouts of Fannie Mae Single-Family Loans

Credit Loss Concentration of Single-Family Conventional Guaranty Book of Business

Cumulative Default Rates of Single-Family Conventional Guaranty Book of Business by Origination Year 18

17

Additional Credit Information for Fannie Mae Single-Family Loans

Multifamily Credit Profile by Loan Atributes

Serious Delinquency Rates of Multifamily Book of Business

Cumulative Credit Loss Rates of Multifamily Guaranty Book of Business By Acquisition Year 22

21

19-20

Credit Profile of Fannie Mae Multifamily Loans

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

-3.6%

-9.1%

-4.8% -4.2%

-3.5%

2.6%

4.0%

7.7%

4.3% 4.7%

5.8%

0.5%

Fannie Mae Home Price Index

Based on our home price index, we estimate that home prices on a national basis increased by 0.5% in the first quarter of 2017, folowing increases of 5.8% in

2016, 4.7% in 2015, and 4.3% in 2014. Despite the recent increases in home prices, we estimate that, through March 31, 2017, home prices on a national basis

remained 0.7% below their peak in the third quarter of 2006. Our home price estimates are based on preliminary data and are subject to change as additional data

become available.

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

1.7% -5.4% -12.0% -3.8% -4.1% -3.9% 6.5% 10.7% 4.5% 5.3% 5.7%

S&P/Case-Shiler Index

Home Price Growth/Decline Rates in the U.S.

Note: Estimate based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of March 2017. Including subsequent data may lead to materialy diferent results.

* Year-to-date as of March 2017.

© 2017 Fannie Mae. Trademarks of Fannie Mae. 3

*

One Year Home Price Change as of 2017 Q1*

NC

5.5%

2.5%

MI

8.4%

2.3%

SC

3.5%

1.2%

CA

7.4%

19.6%

WY

-1.3%

0.2%

AR

2.3%

0.5%

IA

3.0%

0.7%

IL

3.2%

3.8%

IN

3.8%

1.1%KS

4.5%

0.5%

LA

3.4%

0.9%

ME

3.7%

0.3%

MO

3.6%

1.3%

MS

1.6%

0.4%

ND

0.5%

0.2%

NM

3.3%

0.5%

OH

4.0%

2.0%

OK

2.2%

0.7%

PA

3.1%

3.0%

VA

2.8%

3.5%

WV

4.1%

0.2%

AZ

7.9%

2.5% AL

2.4%

1.0%

CO

9.4%

2.9%

FL

8.2%

5.6%

GA

6.7%

2.7%

ID

6.7%

0.6%

KY

6.6%

0.6%

MN

5.3%

2.1%

MT

6.8%

0.3%

NE

5.5%

0.5%

NV

6.8%

1.0%

NY

5.2%

5.2%

OR

9.2%

1.8%

SD

5.1%

0.2%

TN

8.4%

1.3%

TX

5.6%

6.1%

UT

8.7%

1.2%

WA

9.9%

3.6%

WI

5.4%

1.8%

State: FL

Growth Rate: 8.2%

UPB%**: 5.6%

United States: 5.5%

*Source: Fannie Mae. Home price estimates are based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of March 2017. UPB estimates are based on data

available through the end of March 2017. Including subsequent data may lead to materialy diferent results.

** “UPB %” refers to unpaid principal balance of loans on properties in the applicable state as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie Mae

has access to loan-level information.

© 2017 Fannie Mae. Trademarks of Fannie Mae. 4

AK

1.7%

0.2%

Growth

Rate UPB %**

CT

DC

DE

MA

MD

NH

NJ

RI

VT 0.2%

0.3%

3.8%

0.5%

2.7%

2.9%

0.4%

0.4%

1.3%

2.4%

8.2%

3.6%

5.5%

2.5%

6.2%

3.9%

11.5%

0.7%

HI

4.8%

0.7%

State Growth Rate

Below 0%

0% to 5%

5% to 10%

10% and Above

NC

5.1%

2.5%

SC

2.1%

1.2%

MI

-5.8%

2.3%

AZ

-21.0%

2.5%

FL

-21.9%

5.6%

NV

-28.2%

1.0%

IL

-13.5%

3.8%

CA

-9.4%

19.6%

CO

34.0%

2.9%

IA

13.7%

0.7%

KS

12.9%

0.5% KY11.4%

0.6%

LA

16.4%

0.9%

MT

19.4%

0.3%

ND

51.8%

0.2%

NE

17.4%

0.5%

OK

15.2%

0.7%

SD

25.9%

0.2%

TN

13.0%

1.3%

TX

32.1%

6.1%

UT

18.0%

1.2%

WY

12.2%

0.2%

VA

-9.1%

3.5%

GA

-2.5%

2.7%

ME

-1.5%

0.3%

MN

-2.6%

2.1%

NM

-4.9%

0.5%

OH

-1.9%

2.0%

AL

0.4%

1.0%

AR

4.5%

0.5%

ID

0.6%

0.6%

MO

2.7%

1.3%

MS

0.4%

0.4%

NY

0.6%

5.2%

PA

3.5%

3.0%

OR

9.6%

1.8%

WA

9.3%

3.6%

WV

6.1%

0.2%

IN

7.6%

1.1%

WI

0.4%

1.8%

State: FL

Growth Rate : -21.9%

UPB%**: 5.6%

United States: -0.7%

Home Price Change From 2006 Q3 Through 2017 Q1*

*Source: Fannie Mae. Home price estimates are based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of March 2017. UPB estimates are based on data available through the

end of March 2017. Including subsequent data may lead to materialy diferent results.

** “UPB %” refers to unpaid principal balance of loans on properties in the applicable state as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie Mae has access to

loan-level information.

Note: Home prices on a national basis reached a peak in the third quarter of 2006.

© 2017 Fannie Mae. Trademarks of Fannie Mae. 5

AK

11.4%

0.2%

HI

5.6%

0.7%

Growth

Rate UPB %**

CT

DC

DE

MA

MD

NH

NJ

RI

VT 0.2%

0.3%

3.8%

0.5%

2.7%

2.9%

0.4%

0.4%

1.3%

-1.7%

-15.8%

-18.3%

-6.7%

-18.0%

1.4%

-12.8%

44.3%

-19.5%

State Growth Rate

Below -15%

-15% to -5%

-5% to 0%

0% to 5%

5% to 10%

10% and Above

Q1 2017

Single-Family

Acquisitions

Excl.

Refi Plus

Ful Year 2016

Single-Family

Acquisitions

Excl.

Refi Plus

Q4 2016

Single-Family

Acquisitions

Excl.

Refi Plus

Q3 2016

Single-Family

Acquisitions

Excl.

Refi Plus

Q2 2016

Single-Family

Acquisitions

Excl.

Refi Plus

Q1 2016

Single-Family

Acquisitions

Excl.

Refi Plus

Unpaid Principal Balance (UPB) ($B)

Weighted Average Origination Note Rate 4.00%

$113.4

4.00%

$118.5

3.73%

$558.9

3.74%

$581.0

3.57%

$173.1

3.58%

$178.2

3.66%

$160.2

3.66%

$165.6

3.82%

$129.2

3.83%

$135.0

4.01%

$96.4

4.02%

$102.2

<= 60%

60.01% to 70%

70.01% to 80%

80.01% to 90%

90.01% to 100%

> 100%

Weighted Average Origination LTV Ratio 73.3%

0.0%

14.8%

11.1%

38.6%

14.4%

21.1%

73.2%

0.3%

14.5%

11.1%

37.8%

14.5%

21.7%

73.6%

0.0%

14.8%

11.5%

38.8%

14.5%

20.4%

73.6%

0.4%

14.6%

11.6%

38.1%

14.5%

20.7%

72.0%

0.0%

12.8%

10.6%

37.5%

15.6%

23.5%

71.9%

0.2%

12.7%

10.7%

37.1%

15.6%

23.8%

73.9%

0.0%

15.5%

11.7%

38.4%

14.2%

20.2%

73.8%

0.3%

15.3%

11.8%

37.8%

14.3%

20.6%

74.8%

0.0%

16.3%

12.2%

39.7%

13.8%

18.0%

74.7%

0.4%

16.0%

12.3%

38.9%

13.9%

18.5%

74.6%

0.0%

15.3%

12.0%

40.8%

13.8%

18.1%

74.5%

0.6%

15.0%

12.2%

39.6%

13.9%

18.7%

Origination Loan-to-Value (LTV) Ratio

< 620

620 to < 660

660 to < 700

700 to < 740

>=740

Weighted Average FICO Credit Score 747

60.4%

22.2%

12.7%

4.7%

0.0%

746

59.4%

22.1%

13.0%

5.0%

0.4%

752

64.9%

20.4%

10.9%

3.8%

0.0%

750

63.9%

20.4%

11.3%

4.1%

0.3%

754

66.9%

19.8%

10.0%

3.3%

0.0%

753

66.1%

19.8%

10.3%

3.6%

0.2%

753

66.1%

19.9%

10.4%

3.6%

0.0%

752

65.2%

19.9%

10.7%

3.9%

0.3%

751

63.6%

21.1%

11.4%

3.8%

0.0%

749

62.5%

21.0%

11.8%

4.2%

0.4%

748

61.2%

21.5%

12.6%

4.7%

0.0%

746

59.8%

21.4%

13.0%

5.2%

0.5%

FICO Credit Scores

Credit Characteristics of Single-Family Business Acquisitions

Fixed-rate

Adjustable-rate

Alt-A

Interest Only

Investor

Condo/Co-op

Refinance 53.4%

9.9%

7.3%

0.0%

0.0%

2.2%

97.8%

55.4%

9.8%

7.7%

0.0%

0.3%

2.1%

97.9%

54.0%

9.6%

5.6%

0.0%

0.0%

1.6%

98.4%

55.7%

9.6%

6.0%

0.0%

0.3%

1.5%

98.5%

60.1%

9.4%

5.5%

0.0%

0.0%

1.1%

98.9%

61.2%

9.4%

5.7%

0.0%

0.2%

1.1%

98.9%

51.5%

9.5%

5.2%

0.0%

0.0%

1.6%

98.4%

53.0%

9.5%

5.4%

0.0%

0.2%

1.6%

98.4%

51.3%

10.0%

5.7%

0.0%

0.0%

1.5%

98.5%

53.4%

9.9%

6.1%

0.0%

0.3%

1.5%

98.5%

50.9%

9.7%

6.6%

0.0%

0.0%

2.4%

97.6%

53.7%

9.7%

7.1%

0.0%

0.4%

2.3%

97.7%

Certain Characteristics

Purchase

Cash-out refinance

Other refinance 28.7%

24.7%

46.6%

31.8%

23.6%

44.6%

33.9%

20.1%

46.0%

36.4%

19.3%

44.3%

38.6%

21.5%

39.9%

40.3%

20.9%

38.8%

33.0%

18.4%

48.5%

35.2%

17.8%

47.0%

32.1%

19.2%

48.7%

35.0%

18.4%

46.6%

29.4%

21.6%

49.1%

33.4%

20.4%

46.3%

Loan Purpose

Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization transactions.

Single-family business acquisitions for the applicable period excluding loans acquired under our Refi Plus initiative, which includes the Home Afordable Refinance Program ® (“HARP ®”). Our Refi Plus initiative provides expanded refinance

opportunities for eligible Fannie Mae borowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan.

Newly originated Alt-A loans for the applicable periods consist of the refinance of existing loans under our Refi Plus initiative. For a description of our Alt-A loan classification criteria, refer to Fannie Mae’s 2016 Form 10-K.

(1)

(2)

(3)

(4)

Single-Family Acquisitions

5.4%

7.1%

23.0%

Single-Family Acquisitions

4.9%

6.9%

22.8%

Single-Family Acquisitions

California

Texas

Florida 6.0%

7.3%

20.3%

Single-Family Acquisitions

5.8%

7.6%

21.7%

Single-Family Acquisitions

4.6%

6.3%

23.7%

Single-Family Acquisitions

5.1%

6.9%

22.9%

© 2017 Fannie Mae. Trademarks of Fannie Mae. 6

Acquisition Period

(4)

(2) (2) (2) (2) (2) (2)

(3)

(1)

Top 3 Geographic Concentrations

Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization

transactions.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan. FICO credit scores at origination below 620 primarily consist of the refinance of existing loans under our Refi Plus

initiative, which includes the Home Afordable Refinance Program (“HARP”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae borowers, and may involve the refinance

of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%.

Single-family business acquisitions for the applicable period excluding loans acquired under our Refi Plus initiative, which includes HARP.

<= 60%

60.01%

to 80%

80.01%

to 100% > 100% Total

>=740

660 to < 740

620 to < 660

< 620

Total 100.0%

0.4%

5.0%

35.2%

59.4%

0.3%

0.0%

0.0%

0.2%

0.1%

25.7%

0.1%

1.1%

10.3%

14.2%

52.3%

0.1%

2.8%

18.4%

30.9%

21.7%

0.1%

1.1%

6.3%

14.2%

<= 60%

60.01%

to 80%

80.01%

to 100% > 100% Total

>=740

660 to < 740

620 to < 660

< 620

Total 100.0%

0.5%

5.2%

34.4%

59.8%

0.6%

0.1%

0.1%

0.3%

0.2%

27.2%

0.1%

1.2%

10.6%

15.2%

53.5%

0.2%

2.8%

18.3%

32.1%

18.7%

0.1%

1.0%

5.2%

12.3%

<= 60%

60.01%

to 80%

80.01%

to 95% >95% Total

>=740

660 to < 740

620 to < 660

Total 100.0%

4.7%

34.9%

60.4%

3.3%

0.1%

1.6%

1.6%

22.6%

0.8%

8.8%

13.0%

53.0%

2.7%

18.6%

31.7%

21.1%

1.0%

6.0%

14.1%

<= 60%

60.01%

to 80%

80.01%

to 95% >95% Total

>=740

660 to < 740

620 to < 660

Total 100.0%

4.7%

34.1%

61.2%

1.8%

0.1%

0.9%

0.8%

25.5%

1.0%

9.7%

14.7%

54.6%

2.7%

18.6%

33.3%

18.1%

0.9%

4.9%

12.3%

Credit Profile for Single-Family Acquisitions (Excluding Refi Plus)

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

FIC

O

Cr

ed

it S

co

re

(1)

(2)

(3)

© 2017 Fannie Mae. Trademarks of Fannie Mae. 7

<= 60%

60.01%

to 80%

80.01%

to 95% >95% Total

>=740

660 to < 740

620 to < 660

Total 0.0%

0.0%

0.8%

-0.8%

1.5%

0.0%

0.7%

0.8%

-2.9%

-0.1%

-1.0%

-1.8%

-1.6%

0.0%

0.0%

-1.6%

3.0%

0.1%

1.0%

1.8%

<= 60%

60.01%

to 80%

80.01%

to 100% > 100% Total

>=740

660 to < 740

620 to < 660

<620

Total 0.0%

-0.2%

-0.2%

0.7%

-0.4%

-0.3%

0.0%

0.0%

-0.1%

-0.1%

-1.5%

-0.1%

-0.2%

-0.3%

-0.9%

-1.2%

-0.1%

-0.1%

0.1%

-1.2%

3.0%

0.0%

0.1%

1.1%

1.8%

Credit Profile for Single-Family Acquisitions

Credit Risk Profile Summary of Single-Family Business Acquisitions

For the Three

Months Ended

March 31, 2017

For the Three

Months Ended

March 31, 2017

For the Three

Months Ended

March 31, 2016

For the Three

Months Ended

March 31, 2016

Change in

Acquisitions

Profile

Change in

Acquisitions

Profile

Origination LTV Ratio Origination LTV Ratio Origination LTV Ratio

Origination LTV Ratio Origination LTV Ratio Origination LTV Ratio

(2) (2) (2)

(2) (2) (2)

(3)

(1)

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

40%

60%

80%

100%

Or

igin

ati

on

LT

V R

ati

o

0%

5%

10%

15%

20%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

Origination Loan-to-Value (OLTV) Ratio

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

660

680

700

720

740

760

780

FIC

O

Cr

ed

it S

co

re

0%

5%

10%

15%

20%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

FICO Credit Score

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0%

20%

40%

60%

80%

100%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

Share of Single-Family Business Acquisitions:

Fixed-rate Product

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0%

20%

40%

60%

80%

100%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

Share of Single-Family Business Acquisitions:

Loan Purpose - Purchase

Product Feature

Weighted Average Origination LTV Ratio Origination LTV > 90% Weighted Average FICO Credit Score FICO Credit Score < 620

Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization

transactions.

FICO credit score is as of loan origination, as reported by the seler of the mortgage loan. Loans acquired after 2009 with FICO credit scores at origination below 620 primarily consist of the refinance of existing

loans under our Refi Plus initiative, which includes HARP.

Certain Credit Characteristics of Single-Family Business Acquisitions: 2006 - 2017

(1)

(2)

.

© 2017 Fannie Mae. Trademarks of Fannie Mae. 8

* Year-to-date through March 31, 2017.

(2)

(1)

**

* *

2010 2011 2012 2013 2014 2015 2016 2017

0%

20%

40%

60%

80%

100%

%

of

Sin

gle

-Fa

mi

ly B

us

ine

ss

Ac

qu

isit

ion

s

1%1%2%

3%3%4%6%

14%16%10%10%

6%

9%9%14%14%

51%52%48%36%

48%

55%52%54%

45%44%45%52%

30%

21%24%23%

Single-Family Business Acquisitions by Loan Purpose

HARP Refi Plus Acquisitions (Excluding HARP) Refinance Acquisitions (Excluding Refi Plus) Purchase Acquisitions

2010

HARP

Refi Plus

(Excl.

HARP)

2011

HARP

Refi Plus

(Excl.

HARP)

2012

HARP

Refi Plus

(Excl.

HARP)

2013

HARP

Refi Plus

(Excl.

HARP)

2014

HARP

Refi Plus

(Excl.

HARP)

2015

HARP

Refi Plus

(Excl.

HARP)

2016